In today’s complex financial landscape, traditional buy-and-hold approaches can leave investors exposed to unforeseen downturns and missed opportunities. Adaptive investing offers a compelling alternative by navigating through ever-changing market conditions and reshaping portfolios in response to new data.

This dynamic methodology draws on evolutionary finance, behavioral insights, and real-time analytics to create resilient strategies. By tuning allocations to economic cycles, volatility shifts, and market trends, investors aim to capture gains while mitigating risk.

Below, we explore the foundations, strategies, tools, and benefits of adaptive investing, guiding you toward a proactive approach that evolves alongside global markets.

Understanding the Adaptive Investing Concept

At the heart of adaptive investing lies the adaptive market hypothesis offers a fresh perspective: markets are not always fully efficient, but evolve as participants learn, innovate, and adapt. This theory blends principles from evolutionary biology with behavioral finance, viewing market inefficiencies as windows of opportunity.

Rather than adhering to static models, adaptive strategies continuously assess incoming data—economic indicators, volatility measures, and trend signals—to inform timely shifts. The goal is to align portfolio exposures with prevailing market regimes, whether expansionary, contractionary, or transitional.

Key Adaptive Strategies

Adaptive investing typically employs three primary approaches. When combined, they form a robust framework for dynamic allocation.

- Adaptive Regime Approach: Adjusts weightings based on economic cycles. In expansions, increase equities, commodities, and high-yield bonds; in contractions, move to Treasuries or cash.

- Adaptive Return/Momentum Approach: Employs technical indicators and trend-following. Buy assets showing strength, rotate out of underperformers.

- Adaptive Risk/Volatility Approach: Targets volatility metrics. Reduce exposure during spikes, rebuild positions in stable periods.

By integrating regime detection with momentum and volatility targeting, investors can pursue dynamically adjusting portfolios to market conditions and reduce drawdowns without sacrificing upside participation.

Incorporating an Integrated Approach

Rather than relying on a single tactic, many adaptive strategies fuse the three approaches into a unified model. This enhanced performance via trend capture and regime shifts while maintaining risk discipline.

Implementation often uses liquid, low-cost ETFs across global equity, fixed income, commodity, and real estate sectors. Portfolios rebalance periodically—monthly or quarterly—based on algorithmic signals rather than preset benchmarks.

Such integrated strategies deliver a balanced mix of market beta drivers, resembling tactical asset allocation and global macro frameworks, but without leverage or short positions.

Tools and Methodologies for Success

Effective adaptive investing demands sophisticated tools and rigorous frameworks to detect regime changes, forecast returns, and manage risk.

- Scenario Planning and Stress Testing: Model multiple futures—from mild recessions to regulatory shifts—to gauge portfolio resilience.

- Dynamic Analytics and Algorithms: Real-time data feeds on economic indicators, volatility indices, and sustainability metrics drive decision engines.

- Diversification and Flexibility: Maintain broad asset class exposure with the optionality to reweight rapidly.

- Proactive Risk Mitigation Strategies: Identify emerging threats—tail risks, climate shocks, or policy changes—and adjust hedges accordingly.

Performance Insights and Benefits

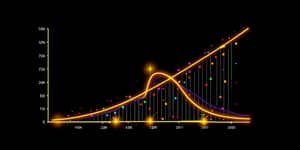

Historical backtests illustrate the power of adaptive investing in reducing risk and boosting risk-adjusted returns:

Key advantages include:

- Consistent returns across varying conditions by rotating into favorable regimes.

- Enhanced risk mitigation through volatility targeting and de-risking in downturns.

- Opportunity to exploit market inefficiencies for incremental gains beyond passive benchmarks.

- Tail-risk focus that helps preserve capital during steep sell-offs.

Over the long term, adaptive portfolios aim to deliver smoother ride and superior outcomes in uncertain environments.

Challenges and Considerations

Despite its appeal, adaptive investing is not without hurdles. Accurate regime detection requires robust data infrastructure and sophisticated analytics. Signal misfires can lead to suboptimal shifts, and transaction costs may erode performance if rebalancing is too frequent.

Investors must guard against overfitting models to historical data and remain vigilant for regime changes outside modeled scenarios. A disciplined governance framework and ongoing model validation are essential to sustain results.

Embracing the Future of Adaptive Investing

As global markets grow more interconnected and susceptible to rapid sentiment swings, the case for adaptive strategies only strengthens. By harnessing the principles of the adaptive market hypothesis and leveraging modern technology, investors can build portfolios that not only survive but thrive across cycles.

Whether you’re a seasoned professional or a DIY enthusiast, integrating dynamic allocation methods can transform how you navigate volatility, capitalize on trends, and manage risk. Adaptive investing represents a paradigm shift—a move away from static allocations toward a truly responsive, data-driven approach.

Embrace adaptability, refine your investment toolkit, and let your portfolio evolve in step with the market’s ever-changing rhythms.

References

- https://pollution.sustainability-directory.com/term/adaptive-financial-strategies/

- https://www.mcroc.co.nz/blog/adaptive-investment-strategies-navigating-dynamic-markets

- https://interactiveadvisors.com/sizemore-capital?portfolio=adaptive-asset-allocation

- https://www.janushenderson.com/en-us/institutional/product/adaptive-global-allocation/

- https://www.highlandwealthpartners.com/blog/adaptive-financial-strategies-for-a-dynamic-world

- https://rpc.cfainstitute.org/research/financial-analysts-journal/2017/adaptive-markets-financial-evolution-at-the-speed-of-thought