Embarking on your investment journey can feel overwhelming, but mastering asset allocation is the key to unlocking financial peace of mind. It balances risk against reward by thoughtfully distributing your portfolio across various assets.

At its core, asset allocation is about creating a harmonious mix that aligns with your personal goals. Diversification through asset allocation ensures that your investments are not overly dependent on any single market movement.

This strategy is often hailed as the only free lunch in investing, as it reduces overall risk without sacrificing potential returns. By understanding how different asset classes interact, you can build a resilient portfolio.

The Heart of Asset Allocation

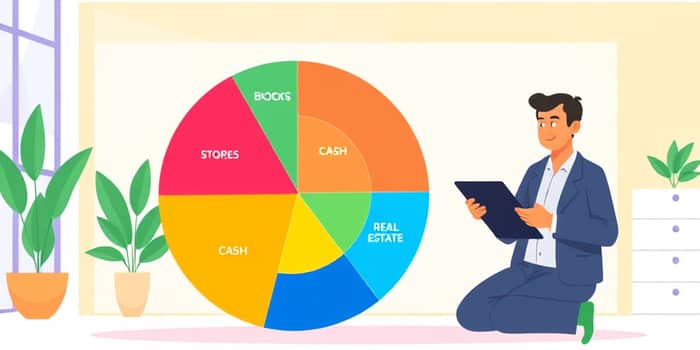

Asset allocation divides your investments among categories like stocks, bonds, and cash. It focuses on the portfolio's overall characteristics rather than picking individual winners.

This approach leverages the fact that asset classes perform differently in various economic conditions. Their returns are not perfectly correlated, which smooths out volatility over time.

For instance, when stocks decline, bonds might hold steady or rise, providing a buffer. This synergy is what makes asset allocation so powerful for long-term growth.

Why Your Allocation Drives Success

Research shows that asset allocation explains about 40% of the return differences between portfolios. The rest comes from security selection, timing, and fees.

If one portfolio outperforms another by 5%, roughly 2% is due to allocation choices. This highlights how critical it is to get your mix right from the start.

Asset allocation not only determines future returns but also how well your portfolio endures bear markets. A well-balanced allocation can shield you from severe losses.

By maximizing gains while managing risks, you align with modern portfolio theory principles. This disciplined approach helps you stay focused on long-term objectives.

Factors Shaping Your Allocation

Several personal factors influence how you should allocate your assets. Here are the key considerations:

- Goals: Your aspirations, such as saving for retirement or a home, dictate the return targets and risk levels you need to achieve.

- Risk Tolerance: Risk-averse investors might favor secure assets like bonds, while aggressive ones pursue higher returns with volatile stocks.

- Time Horizon: Long-term goals allow for higher risk, so you might allocate more to stocks for growth. Short-term needs favor stability with cash.

- Age and Life Stage: Rules like "100 minus age" suggest the percentage to invest in stocks, adjusting as you grow older.

Understanding these factors ensures your allocation reflects your unique financial situation. It is the first step toward a tailored investment plan.

A Guide to Major Asset Classes

Understanding the building blocks of your portfolio is essential. Here’s a breakdown of the primary asset classes:

For example, a $10,000 retirement plan with a five-year horizon and moderate risk might allocate 50% to stocks, 40% to bonds, and 10% to cash.

This mix balances growth potential with safety, tailored to your specific needs. It is a practical starting point for many investors.

Strategies to Implement Asset Allocation

There are various approaches to asset allocation, each suited to different investor profiles. Here are some popular strategies:

- Strategic Allocation: Involves a fixed long-term mix, like 60% stocks and 40% bonds, ignoring short-term market fluctuations for optimal risk-return balance.

- Dynamic Allocation: Adjusts the original mix based on economic changes while maintaining core exposure, offering flexibility for market trends.

- Tactical Allocation: Actively shifts to high-potential assets or sectors for short-term maximization, suitable for experienced investors.

- Core-Satellite Allocation: Combines a large strategic core with small tactical bets, providing stability with opportunistic upside.

- Age-Based or Target-Date Allocation: Dynamically adjusts over time, shifting from stocks to bonds as retirement approaches, often used in life-cycle funds.

Rebalancing is crucial to maintain your desired allocation. Methods include redirecting contributions to underweight classes or selling overweights to reinvest.

This ensures your portfolio stays aligned with your goals, even as markets fluctuate. It is a key aspect of disciplined investing.

Practical Examples and Portfolio Models

To illustrate, here are some common portfolio models based on risk tolerance:

- Conservative Portfolio: Typically 50% bonds and cash, with 50% stocks, focusing on capital preservation.

- Moderate Portfolio: Allocates 50-70% to stocks, with the rest in bonds and cash, balancing growth and safety.

- Aggressive Portfolio: Holds 70% or more in stocks, aiming for maximum long-term growth with higher volatility.

An investor might start with 70% stocks, 20% bonds, 5% REITs, and 5% cash. Over five years, if risk tolerance increases, they could shift to 65% stocks and 35% bonds.

This evolution reflects changing life stages and financial objectives. It highlights the dynamic nature of asset allocation.

Common Pitfalls to Avoid

Even with a solid plan, investors can stumble. Watch out for these mistakes:

- Over-reacting to market trends instead of sticking to your long-term allocation plan.

- Ignoring life changes that should prompt a reassessment of your risk tolerance and goals.

- Failing to rebalance regularly, which can lead to unintended risk exposures.

- Chasing past performance without considering future market conditions.

Avoiding these pitfalls requires discipline and regular review. It helps you stay on track toward financial success.

Tools for Effective Implementation

You can implement asset allocation through various tools:

- Direct purchase of securities like individual stocks and bonds.

- Mutual funds and ETFs that provide instant diversification across asset classes.

- Robo-advisors or financial advisors for guided allocation based on your profile.

- Online calculators and software to model different allocation scenarios.

These tools make it easier to execute and monitor your strategy. They empower you to take control of your investments.

Embracing the Journey

Asset allocation is not a one-time task but an ongoing process. By regularly reviewing and adjusting your mix, you can stay aligned with your financial dreams.

Remember, the goal is to build a portfolio that grows steadily while weathering market storms. With a thoughtful allocation, you can invest with confidence and clarity.

Start today by assessing your goals and risk tolerance. Your future self will thank you for the foresight and discipline.

Asset allocation is your roadmap to financial resilience. It transforms uncertainty into opportunity, one strategic step at a time.

References

- https://en.wikipedia.org/wiki/Asset_allocation

- https://corporatefinanceinstitute.com/resources/wealth-management/asset-allocation/

- https://www.ssb.texas.gov/sites/default/files/uploads/voi/articles/allocate_your_assets.html

- https://www.finra.org/investors/investing/investing-basics/asset-allocation-diversification

- https://www.youtube.com/watch?v=R_FOYG3KHdo

- https://www.morganstanley.com/atwork/employees/learning-center/articles/asset-allocation-101

- https://investor.vanguard.com/investor-resources-education/how-to-invest/asset-allocation