In the dynamic world of finance, event-driven strategies offer a compelling way to unlock value from market fluctuations.

They focus on exploiting temporary pricing inefficiencies that arise during corporate events, providing a unique edge for savvy investors.

By understanding these opportunities, you can potentially achieve significant returns while navigating complex risks with precision.

What Are Event-Driven Strategies?

Event-driven strategies are investment approaches designed to profit from specific corporate actions.

These strategies target moments when securities are mispriced due to events like mergers or bankruptcies.

They require deep analytical skills and expertise in legal and financial domains.

This makes them a favorite among hedge funds and institutional investors who can leverage sophisticated tools.

Key Corporate Events and Triggers

Corporate events serve as the catalysts for these strategies, creating opportunities for profit.

Here are some common triggers that investors monitor closely:

- Mergers and Acquisitions (M&A), where price gaps can be exploited.

- Bankruptcies and distressed debt scenarios offering recovery potential.

- Restructurings, spin-offs, and share buybacks that reveal undervalued assets.

- Activist investing, where stakes are acquired to push for change.

- Regulatory changes or natural disasters that impact market dynamics.

Each event demands careful analysis to anticipate outcomes and capitalize on mispricings.

Sub-Strategies and Their Mechanics

To implement event-driven strategies, various sub-approaches are employed, each with unique mechanics.

Active management is essential here, involving continuous research and risk assessment.

This table highlights how different tactics can be applied based on the event type.

Historical Context and Examples

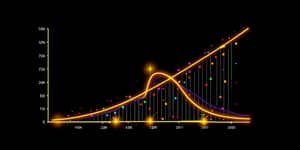

Event-driven strategies have flourished during periods of high corporate activity.

For instance, the 2006 M&A boom saw record volumes of $3.6 trillion, creating a fertile ground for arbitrage.

Hypothetical examples, such as the SSC acquisition, illustrate the potential for profit if deals close successfully.

Real-world cases like Cornwall Capital in the subprime crisis show how these strategies can thrive in volatility.

These historical moments underscore the importance of timing and nimble execution in this field.

Risks and Challenges

While event-driven strategies offer high rewards, they come with significant risks that must be managed.

Key challenges include:

- Event or deal risk, where events may fail due to regulatory blocks or opposition.

- Market sensitivity, though less than broad markets, still requires robust risk management.

- High complexity, demanding expertise to avoid costly mistakes.

- Time value of money and trading costs that can erode profits.

To mitigate these, investors must adopt a disciplined approach and stay informed.

Rewards and Benefits

Despite the risks, the benefits of event-driven strategies are substantial and inspiring.

Notable advantages include:

- High profit potential from correct predictions, leading to significant returns.

- Market independence, as returns are tied to specific events rather than general fluctuations.

- Diversification and alpha generation, providing a hedge in investment portfolios.

- Opportunistic gains from unique views on corporate catalysts.

This makes event-driven strategies a valuable tool for achieving portfolio diversification and outperformance.

Practical Implementation Steps

For those looking to apply event-driven strategies, a structured approach is crucial.

Follow these steps to get started:

- Conduct thorough research on corporate events and their probabilities.

- Use financial modeling to assess terms and potential outcomes.

- Build a diversified portfolio to spread risk across multiple events.

- Implement risk management techniques, such as stop-loss orders or hedging.

- Execute trades swiftly to capitalize on timing and market movements.

Continuous monitoring and adjustment are key to adapting to changing circumstances.

Who Uses These Strategies and Why

Event-driven strategies are primarily employed by sophisticated investors who can handle their complexities.

Typical users include:

- Hedge funds specializing in event-driven investing for high returns.

- Private equity firms and institutional investors with access to capital and expertise.

- Active managers who focus on short-to-medium-term opportunities rather than long-term growth.

For individual investors, these strategies may be challenging due to the need for specialized knowledge and resources.

Conclusion: Embracing Opportunities

Event-driven strategies provide a powerful way to leverage corporate actions for financial gain.

By mastering the mechanics and managing risks, you can tap into unique market inefficiencies.

They offer a path to diversification and alpha, making them a compelling choice in today's financial landscape.

Embrace these opportunities with careful planning and a proactive mindset to unlock their full potential.

References

- https://diversification.com/term/event-driven-strategy

- https://www.poems.com.sg/glossary/strategy/event-driven-strategy/

- https://www.insidearbitrage.com/2024/11/event-driven-investment-strategies/

- https://www.wallstreetprep.com/knowledge/event-driven-investing/

- https://en.wikipedia.org/wiki/Event-driven_investing

- https://www.aurum.com/insight/thought-piece/event-driven-hedge-fund-strategies-explained/

- https://hub.tradier.com/articles/what-are-event-driven-stock-trading-strategies/

- https://www.alliancebernstein.com/us/en-us/investments/insights/investment-insights/beyond-mergers-a-diversified-approach-to-event-driven-investment.html