Imagine a world where your investments don't just keep pace with the market but soar beyond it.

Growth investing offers this thrilling possibility by targeting companies set to outshine their peers.

It focuses on capital appreciation over income to build wealth through innovation and expansion.

This strategy isn't for the faint-hearted, but for those who dream big and act wisely.

What Is Growth Investing?

At its core, growth investing is about identifying firms with explosive potential.

These companies often reinvest earnings to fuel their growth instead of paying dividends.

Investors buy into this vision, hoping for substantial long-term gains.

The journey starts with understanding what makes a growth stock tick.

Identifying the Hallmarks of Growth Stocks

Growth stocks share distinct traits that set them apart in the financial landscape.

- They exhibit high growth metrics, like consistent revenue increases year-over-year.

- Valuations are often elevated, with above-average P/E ratios reflecting future expectations.

- Dividends are minimal or nonexistent as profits are plowed back into the business.

- Common sectors include technology, healthcare, and green energy.

- These companies lead or disrupt industries with cutting-edge innovations.

Recognizing these signs can help you spot opportunities early.

Effective Growth Investing Strategies

There are several approaches to harness the power of growth investing.

- Buy and hold involves accumulating shares in top innovators for multi-year compounding.

- Momentum growth targets surging stocks with strong fundamentals for short-term gains.

- Thematic growth focuses on megatrends like cloud computing or renewable energy.

- GARP (Growth at a Reasonable Price) seeks growth stocks with balanced valuations.

- Diversification across sectors and using dollar-cost averaging reduces risk.

Each strategy requires discipline and a clear plan.

Growth vs. Value: Understanding the Differences

Growth and value investing offer contrasting paths to financial success.

Neither approach is universally superior; blending them can enhance portfolio resilience.

The Risks and How to Mitigate Them

Growth investing comes with significant challenges that require careful management.

- Volatility and high valuations make stocks vulnerable to growth slowdowns.

- There's no income safety net, relying solely on price appreciation.

- Emotional pitfalls like impulsive decisions can derail long-term plans.

- Overpaying for unproven potential is a common risk.

Staying disciplined and diversifying can help navigate these waters.

How to Identify Potential Growth Stocks

Spotting the next big thing involves both art and science.

- Screen for revenue and earnings growth that exceeds market averages.

- Look for innovation signals, such as new products or market expansions.

- Analyze metrics beyond P/E, like profit margins and market share gains.

- Use tools like financial ratios and trend analysis to assess industry trends.

Patience and research are key to uncovering hidden gems.

Historical Insights and Future Projections

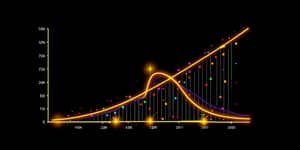

Growth investing has seen cycles of dominance and underperformance over time.

- It surged during the 1990s dotcom era and the post-2010 innovation boom.

- Value investing often leads in downturns or dividend-focused periods.

- Long-term data shows that growth has outperformed value in recent decades.

- Future projections suggest potential shifts, emphasizing the need for adaptability.

Understanding history can guide your investment decisions forward.

Embarking on Your Growth Investing Journey

Start by educating yourself on market trends and company fundamentals.

Set a long-term horizon to ride out volatility and allow compounding to work.

Consider using growth mutual funds or ETFs for diversified exposure.

Regularly review and rebalance your portfolio to stay aligned with your goals.

Remember, growth investing is about betting on tomorrow's leaders.

With courage and insight, you can find the next big thing.

References

- https://www.bajajamc.com/knowledge-centre/growth-investing

- https://www.nerdwallet.com/investing/learn/value-vs-growth-investing-styles

- https://www.financestrategists.com/wealth-management/investment-management/growth-investing/

- https://centraltrust.net/value-vs-growth-investing-whats-the-difference/

- https://heygotrade.com/en/blog/growth-investing-definition

- https://www.hartfordfunds.com/practice-management/client-conversations/investing-for-growth/the-cyclical-nature-of-growth-vs-value-investing.html

- https://www.home.saxo/learn/guides/trading-strategies/growth-investing-what-it-is-and-how-to-build-a-high-growth-portfolio

- https://en.wikipedia.org/wiki/Growth_investing

- https://www.chase.com/personal/investments/learning-and-insights/article/financial-jargon-busting-value-vs-growth-investing

- https://www.fidelity.com/learning-center/investment-products/mutual-funds/2-schools-growth-vs-value

- https://corporatefinanceinstitute.com/resources/career-map/sell-side/capital-markets/a-guide-to-growth-investing/

- https://kirtlandcu.org/growth-vs-value-investing-who-are-you-rooting-for-in-this-duel-of-strategies/

- https://www.bankrate.com/investing/growth-investing/