Imagine a life where your money works tirelessly, generating wealth even as you rest.

That dream is within reach through income stream sculpting, a strategic approach to financial growth.

By designing a portfolio of diverse passive income sources, you can unlock true financial freedom.

This method goes beyond mere earning; it involves crafting a resilient system that thrives with minimal effort.

It contrasts sharply with active income, which ties your earnings directly to your time and labor.

In today's fast-paced world, sculpting your income streams offers a path to stability and peace of mind.

This article will guide you through the principles, strategies, and practical steps to master this art.

Let's embark on a journey to transform your financial future with intelligent planning and execution.

Why Income Stream Sculpting Matters

Financial independence is not just a goal; it's a lifestyle enabled by strategic income management.

Sculpting your income streams reduces reliance on active work, providing a buffer against economic downturns.

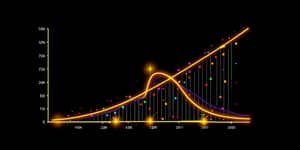

It leverages the power of compounding, where earnings reinvest themselves to accelerate growth exponentially.

Studies show that diversified passive income can lead to long-term wealth accumulation and reduced stress.

By shifting focus from time-based earnings to asset-based returns, you gain control over your financial destiny.

This approach also fosters creativity, as you explore various avenues like investments and digital products.

Ultimately, it's about building a legacy that supports your dreams and aspirations without constant toil.

Here are key benefits to consider:

- Financial freedom through reduced dependency on active work.

- Risk diversification across multiple income sources.

- Tax efficiency with lower rates on passive earnings.

- Scalability that allows growth without proportional effort.

- Peace of mind from stable, recurring revenue streams.

Embrace this mindset to break free from the paycheck-to-paycheck cycle.

Categories of Passive Income Streams

To sculpt effectively, understand the main categories of passive income.

Each type offers unique advantages and challenges, allowing for a tailored portfolio.

Diversification across these streams mitigates risks and enhances overall returns.

Investment-based streams, like dividend stocks and bonds, provide low-entry options with compounding potential.

Real estate offers reliable cash flow and significant tax benefits, such as depreciation deductions.

Business and digital products, including online courses, enable scalable earnings with creative input.

Other ideas, like vending machines, add niche opportunities for income generation.

Here's a comparison to help you choose:

Use this table to assess which streams align with your goals and resources.

Now, explore each category in detail:

- Investment-Based: Includes dividend stocks, ETFs, and high-yield savings accounts.

- Real Estate: Covers rental properties, REITs, and crowdfunding platforms.

- Business/Digital: Encompasses e-books, affiliate marketing, and royalties.

- Other Streams: Such as parking spaces or stock photography commissions.

Remember, some options, like flipping property, require active effort and are not truly passive.

Strategies for Maximizing Your Returns

Effective sculpting requires deliberate strategies to optimize and grow your income streams.

Start by assessing your current financial situation and identifying gaps or opportunities.

Diversification is key; combine different types of streams to balance risks and rewards.

For example, mix dividend-paying investments with rental income for steady cash flow.

Reinvest your earnings to harness compounding, accelerating wealth accumulation over time.

Delegate tasks where possible, such as hiring property managers, to maintain passivity.

Monitor your portfolio minimally, avoiding the temptation to micromanage and trade time for money.

Here are practical steps to transition into income stream sculpting:

- Evaluate your existing income and set clear financial goals.

- Invest upfront capital or time into setting up passive sources.

- Reinvest initial returns to fuel exponential growth.

- Regularly review and adjust your portfolio for optimization.

Additionally, leverage tax perks like deductions for depreciation in real estate.

Scale digital products without proportional effort, ensuring sustainable expansion.

Always conduct thorough research or consult advisors to manage risks effectively.

Common pitfalls include the passive income trap, where focus on income limits upside potential.

Instead, aim for total return strategies that grow principal alongside earnings.

Tax and Financial Considerations

Understanding tax implications is crucial for maximizing passive returns.

Passive income often benefits from lower tax rates and deductions, enhancing net earnings.

For instance, qualified dividends and long-term capital gains are taxed at reduced rates.

Real estate offers deductions for mortgage interest, maintenance, and depreciation.

Unlike active income, most passive earnings avoid Social Security taxes, saving you money.

However, beware of complexities like the passive activity loss rules set by the IRS.

Consult a tax professional to navigate these rules and optimize your strategy.

Here are key tax benefits to leverage:

- Depreciation on rental properties reduces taxable income.

- Lower capital gains rates on investments held long-term.

- Deductions for business expenses in digital ventures.

- No self-employment taxes on most passive streams.

Balancing tax efficiency with investment growth is essential for long-term success.

Real-World Examples and Actionable Tips

Learning from real-world scenarios can inspire and guide your sculpting journey.

Consider an investor who starts with $10,000 in a quantitative trading platform.

With weekly payouts and reinvestment, they build a substantial portfolio over years.

Another example is a creator who develops an online course on a niche topic.

After the initial creation, sales generate ongoing revenue with minimal updates.

These cases highlight the power of strategic setup and patience in passive income.

To get started, focus on actionable steps that fit your budget and interests.

Here are tips to begin sculpting your income streams today:

- Start small with low-entry options like dividend ETFs or high-yield savings.

- Diversify across at least three different income categories for resilience.

- Reinvest all early earnings to accelerate compounding growth.

- Use technology to automate monitoring and management tasks.

- Continuously educate yourself on new opportunities and market trends.

Avoid common mistakes, such as neglecting risk management or over-investing in volatile assets.

By taking consistent action, you can sculpt a portfolio that supports your financial independence dreams.

Remember, the journey requires discipline, but the rewards of freedom and stability are immense.

Embrace the process, learn from setbacks, and celebrate milestones along the way.

References

- https://plenteous.com/blog/property-management/maximizing-earnings-a-guide-to-active-income-vs-passive-income-streams/

- https://yieldfund.com/what-is-passive-income-key-points-to-know/

- https://www.fidelity.com/learning-center/smart-money/passive-income-ideas

- https://www.concreit.com/blog/passive-income-vs-active-income

- https://www.nerdwallet.com/investing/learn/what-is-passive-income-and-how-do-i-earn-it

- https://www.navyfederal.org/makingcents/investing/15-passive-income-idea-to-generate-cash-flow.html

- https://www.whitecoatinvestor.com/effects-of-passive-income/

- https://facet.com/investing/the-passive-income-trap-why-total-return-is-a-smarter-strategy-for-2025/