Inflation erodes the value of money, like an invisible thief that silently erodes your savings. This guide offers practical strategies to safeguard your purchasing power and build a resilient portfolio.

Understanding Inflation: The Invisible Thief

Inflation occurs when the general level of prices for goods and services rises, diminishing what each dollar can buy. Over time, steady inflation can turn a dollar into mere cents in real terms, a process similar to depreciation but affecting the entire economy.

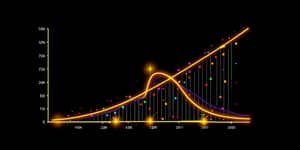

Recent consumer inflation expectations have surged to multidecade highs, making it critical for individuals to address rising costs proactively. Financial experts recommend combining multiple inflation-hedging assets and strategies to preserve wealth.

Core Investment Vehicles for Inflation Protection

Not all financial instruments perform equally during inflationary periods. Some assets adjust directly with rising prices, while others depend on corporate earnings or physical scarcity to outpace inflation.

Treasury Inflation-Protected Securities (TIPS)

TIPS are U.S. Treasury bonds designed to counter inflation by tying principal value to the Consumer Price Index (CPI). With approximately a three-month lag, the principal increases when CPI rises, and interest payments adjust accordingly.

These securities employ a built-in safety net against deflation: if deflation occurs, the principal may decline, but at maturity, investors receive at least their original investment or the inflation-adjusted amount, whichever is higher.

Interest is paid semi-annually at a fixed rate, but actual distributions fluctuate based on the inflation-adjusted principal. During periods of high inflation, interest payments rise; during deflation, they fall.

Real yields on TIPS currently range from 1.9% to 2.6%, allowing investors to lock in returns slightly above inflation. Available maturities include 5-, 10-, and 30-year terms, accommodating various financial timelines.

- Direct link to CPI adjustment, preserving purchasing power

- Fixed interest rate with inflation-adjusted principal

- Government-backed safety and reliable returns

- Deflation protection floor at maturity

I Bonds: An Alternative Inflation Hedge

Series I Savings Bonds also adjust for inflation but feature a combined fixed and variable rate, with interest compounded semi-annually. The variable component aligns with CPI changes, shielding investors from price increases.

Unlike TIPS, tax-deferred until redemption, I Bonds accumulate interest without annual tax liabilities. This avoids the "phantom income" issue that can arise with TIPS holdings in taxable accounts.

However, I Bonds have a $10,000 annual purchase limit per individual and cannot be sold in secondary markets. They must be held at least one year, and redeeming before five years incurs a three-month interest penalty.

Diversified Inflation Protection Strategies

No single asset guarantees perfect inflation protection. A multi-asset approach builds resilience by blending securities that respond differently to rising prices.

- Stocks for long-term growth potential as companies pass along higher costs

- Real estate and infrastructure to hedge rising construction and rent prices

- Commodities and precious metals as traditional hedges against currency depreciation

- Floating-rate loans offering sensitivity to rising interest rates

- Dividend-paying equities providing income and potential dividend growth

Over extended periods, well-diversified portfolios tend to outperform inflation, though short-term volatility can occur when prices spike unexpectedly.

Strategic Portfolio Approaches

Different investors have unique goals, time horizons, and risk tolerances. Tailoring a strategy to your circumstances increases the odds of maintaining purchasing power.

- The Inflation Insurance Approach: Allocate a portion of bond holdings to TIPS as a defensive measure against unexpected spikes.

- The Retirement Shield: Increase TIPS and I Bonds allocation as you near retirement to safeguard income streams.

- The Barbell Strategy: Combine inflation-protected securities with higher-yield bonds to balance inflation defense and income.

- The Tax-Efficient Placement: Hold TIPS in tax-advantaged accounts to minimize phantom income tax impact.

Decision-Making Framework: Questions to Guide You

Assess existing inflation-sensitive assets in your portfolio such as equities, real estate, or commodities and determine their effectiveness over your time horizon.

Evaluate economic scenarios that pose the greatest risk to your portfolio—stagflation, aggressive rate hikes, or supply-driven price shocks.

Clarify which inflation measures matter most for your lifestyle and goals—general CPI, healthcare costs, or education expenses.

Examine your liquidity and governance budgets to ensure you can manage locked-up private assets or complex strategies without undue stress.

Embracing an Inflation-Resilient Future

Inflation is an ever-present force influencing personal finances and long-term plans. By combining TIPS, I Bonds, diversified assets, and strategic allocations, investors can construct a robust shield against rising prices.

Remember, diversification adds resiliency and growth potential, while thoughtful asset placement and regular reviews keep your plan aligned with evolving market realities. With proactive steps and informed decisions, you can protect your purchasing power and pursue financial goals with confidence.

References

- https://districtcapitalmanagement.com/treasury-inflation-protected-securities/

- https://www.risenorthcapital.com/best-investments-for-inflation-protection

- https://www.treasurefi.com/blog/the-impact-of-inflation-why-tips-should-be-in-your-strategy

- https://www.mercer.com/insights/investments/market-outlook-and-trends/inflation-protection-considerations/

- https://www.oakcityproperties.com/unleash-your-financial-power-how-cash-asset-ownership-can-shield-you-from-inflation/

- https://www.dwassetmgmt.com/blog/are-your-investments-safe-from-2025s-inflation-spike

- https://broganfinancial.com/assessing-the-need-for-inflation-protection-in-retirement/

- https://www.schwab.com/learn/story/tips-and-inflation-what-to-know-now

- https://www.kiplinger.com/investing/etfs/603178/shield-your-portfolio-from-inflation

- https://www.fidelity.com/learning-center/trading-investing/inflation-proof-investments

- https://www.thrivent.com/insights/retirement-planning/inflation-risk-what-it-is-and-how-it-might-impact-your-retirement

- https://www.jpmorgan.com/insights/markets-and-economy/top-market-takeaways/tmt-beyond-bonds-how-to-protect-against-inflation-led-shocks

- https://mhgwealth.com/insights/how-does-inflation-affect-investments/

- https://districtcapitalmanagement.com/smart-strategies-to-deal-with-inflation/

- https://www.unfcu.org/financial-wellness/protect-your-money-during-high-inflation/