Empowering children with financial knowledge and practical skills from a young age sets them on a path toward independence, confidence, and long-term success. By weaving everyday opportunities into lessons about money, parents and educators can cultivate responsible habits that last a lifetime.

The Importance of Early Financial Education

Financial habits begin to take root by age seven, according to Cambridge research. Yet only 20% of baby boomer parents taught their children about saving, a stark contrast to today’s landscape where 93% of parents take action to guide their kids. When children handle real money, they develop hands-on money management experience that fosters financial self-efficacy and reduces future debt.

Long-term outcomes are clear: kids raised with strong financial education are 1.5 times more likely to successfully negotiate pay raises in adulthood, and Americans who grew up with healthy money habits enjoy better credit scores, higher pay, and lower debt levels. Merely having a savings account in a child’s name makes them six times more likely to attend college.

Practical Hands-On Methods

Young children learn best through tangible experiences. Physical paper currency stimulates cognitive connections between value and exchange. Toddlers as young as three grasp basic concepts, while 5-to-10-year-olds display emotional responses to spending and saving that predict real behavior.

- Small weekly allowances introduce work ethic by tying chores to earnings, teaching kids to balance spending, saving, and giving.

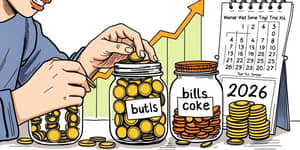

- Three-slot piggy banks for saving spending and giving, reinforced with labeled jars for visual tracking.

- Opening a custodial savings account encourages longer-term goals and sixfold higher college attendance.

To deepen the impact, parents can adopt a three-category system for every dollar: allocate 10-30-60 percent divisions to giving, saving, and spending. When the save jar fills, transition funds to a bank, celebrating milestones and building confidence.

Goal Setting and Delayed Gratification

Setting clear, achievable goals helps children experience the reward of patience. Use concrete examples: saving $5 a week for seven weeks to buy a $35 toy, including a simple calculation of sales tax to reinforce math skills.

Across age groups, teaching kids to help kids create savings goals fosters self-discipline and real-world budgeting sense. Encourage them to earn the full cost of desired items to avoid debt and appreciate the value of hard work.

Advanced Strategies for Teens

As children approach adolescence, it’s time to introduce more sophisticated tools. Setting up a custodial Roth IRA at age 14 empowers teens to start investing early. Supervised credit cards, with strict parental oversight, teach responsible borrowing and on-time payments.

Budgeting for specific categories like clothing, entertainment, and savings sharpens decision-making skills. Summer jobs and paid internships provide real wages, reinforcing the connection between effort and reward. Financial literacy classes can cover checking accounts, interest rates, and the dangers of high-interest debt.

- Custodial Roth accounts for long-term investing experience.

- Parental matching programs, such as 2:1 contributions for college savings.

- Summer internships that combine work and financial education.

Open Communication and Modeling

Children learn as much from observation as from instruction. Regular conversations about budgeting de-stigmatize money topics and invite questions. Share family goals and invite kids to propose their own.

When grocery shopping, involve children in comparing unit prices, making lists, and discussing the cost-benefit of repairing versus replacing items. Demonstrating responsible spending and budgeting shows that financial responsibility is a lifestyle, not a lecture.

Experts recommend beginning modeling from as early as age three. By naming every dollar—assigning it a role—children internalize the purpose behind each cent and develop lifelong financial wisdom.

Community Programs and Overcoming Barriers

For families seeking structured support, community initiatives can make a difference. Programs like Future Bound Miami provide free savings accounts for kindergarteners with up to $50 initial deposits. Summer Youth Internship Programs couple paid work with financial literacy courses through local credit unions.

- Trust-funded camps offering interactive money workshops.

- After-school initiatives teaching budgeting and smart spending.

- Mentorship schemes pairing teens with financial professionals.

Despite these opportunities, money remains taboo in many households, and socioeconomic factors can create barriers. Low-income families may normalize credit card debt. By unlearning unhealthy patterns and focusing on small, consistent teaching efforts, parents can empower children to break the cycle.

Financial education is not about shielding kids from challenges, but equipping them to navigate decisions with resilience and wisdom. Every coin saved, every budget planned, and every open discussion lays the groundwork for a future of confidence and opportunity.

References

- https://www.fdic.gov/consumer-resource-center/2020-09/teaching-children-about-money-now-pays-dividends-later

- https://www.nerdwallet.com/banking/studies/survey-most-parents-teach-their-kids-about-saving-money

- https://www.thechildrenstrust.org/news/parenting-our-children/kids-and-money-teaching-them-early-to-handle-their-finances/

- https://marriott.byu.edu/magazine/feature/money-talks-teaching-kids-financial-fluency

- https://michiganross.umich.edu/rtia-articles/new-research-shows-children-form-attitudes-about-money-young-age

- https://www.theepochtimes.com/business/teaching-kids-about-money-pays-off-in-adulthood-survey-finds-5815413

- https://www.empower.com/the-currency/money/teaching-kids-about-money-news

- https://www.semanticscholar.org/paper/Children-and-Money-Teaching-Children-Money-Habits-Danes/03510cf9615c281ee134e8471ed97e41aacb8bc3