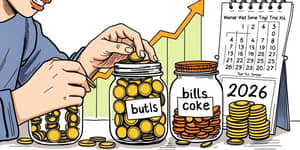

In 2026, financial pessimism is reaching new heights, with 32% of Americans expecting their personal finances to worsen.

This is the highest level of concern since 2018, driven largely by persistent high inflation.

The need for effective strategies has never been more urgent to navigate these challenging times.

Only 34% anticipate improvement in their finances, down from 44% last year.

This decline highlights a growing crisis of confidence in traditional money management approaches.

Small, consistent actions can reverse this trend and build a brighter financial future.

By embracing incremental habits, you can transform uncertainty into security and growth.

The compound effect is key to unlocking significant wealth over time through minor adjustments.

The Power of Incremental Change

Small steps, when taken regularly, create a ripple effect that compounds into substantial outcomes.

This concept, known as the compound effect, turns everyday financial decisions into long-term success.

It reduces overwhelm by focusing on manageable actions rather than drastic overhauls.

For example, saving just $27 a day instead of aiming for $10,000 a year can build momentum.

This approach helps form sustainable habits that stick, leading to consistent progress.

The psychology behind this method emphasizes patience and persistence over quick fixes.

Top Financial Goals for 2026

Setting clear goals is a fundamental step toward financial improvement.

According to recent surveys, Americans are prioritizing specific objectives to enhance their money management.

- Pay down debt: 19%, with this goal increasing with age, especially among seniors dealing with high-cost credit card debt.

- Higher-paying job or additional income: 14%, reflecting the desire for greater earning potential.

- Save more for emergencies: 13%, highlighting the importance of a safety net in uncertain times.

- Budget spending better: 12%, focusing on smarter allocation of resources.

44% of people plan to address these goals immediately as New Year's resolutions.

35% prefer to start after careful planning, ensuring a more structured approach.

Core Money Habits to Transform Your Finances

Adopting smart habits can lead to dramatic improvements in your financial health.

These practices are grouped into key themes for easy implementation and maximum impact.

Budgeting and Tracking

Creating and sticking to a budget is essential for understanding your money flow.

Use tools like spreadsheets or apps to track income and expenses with precision.

- Set category limits to control spending and identify areas for cuts.

- Record every expense for one month to gain insights into your financial patterns.

- Track spending daily to maintain awareness and make informed decisions.

Cut one non-essential item monthly, such as dining out or unused subscriptions.

Regularly monitor your credit score to spot issues early and secure better loan rates.

Saving and Automation

Automating your savings ensures consistency and removes the temptation to spend.

Transfer funds from checking to savings or retirement accounts automatically on payday.

- Start with small amounts, like $10 a week, to build the habit without stress.

- Switch to high-yield savings accounts, which offer rates 10 to 11 times higher than traditional options.

- Build an emergency fund by prioritizing 3 to 6 months' expenses through regular contributions.

Increase retirement contributions by 1% yearly to leverage the power of compounding growth.

Redirect small savings from habits like buying one less drink out per week.

Debt and Credit Management

Paying down high-interest debt should be a top priority before heavy investing.

Aim to allocate 15% of your income to retirement only after addressing significant debts.

- Avoid autopilot spending by using credit responsibly and steering clear of payday loans.

- Ditch bad habits such as impulse buys and unused subscriptions that drain resources.

- Set specific goals for debt payoff to stay motivated and on track.

This focus can free up income for other financial objectives, improving overall stability.

Income and Investing

Seeking additional income through side hustles is a growing trend in 2026.

Leverage AI tools for quick launches, such as automated bookkeeping or instant payouts.

- Start investing even with small amounts, using robo-advisors for tailored portfolio management.

- Employ AI budgeting apps to predict spending and alert you to unnecessary fees.

- Set clear, specific targets like saving for a vacation or paying off debt to maintain motivation.

Review your goals quarterly to adjust strategies and ensure continued progress.

Emerging Trends: Technology in Finance

AI integration is revolutionizing personal finance, offering new ways to optimize money management.

Budget apps can now predict spending patterns, helping you avoid overspending.

Robo-advisors tailor investment portfolios based on your risk tolerance and goals.

- Automatically route cash to debt payments or investments for efficient allocation.

- Enhanced fraud detection provides added security in digital transactions.

- Monitor for lower interest rates to refinance debt and reduce costs.

Stay updated on tax rule changes, as small adjustments can yield real savings over time.

Implementation Strategies for Success

Starting small is crucial to building lasting habits and avoiding burnout.

Focus on one change per month, such as cutting coffee expenses, then automating savings.

- Use financial apps for nudges and reminders to stay on track with your goals.

- Celebrate small wins to build momentum and encourage further positive actions.

- Incremental savings, like a 1% retirement bump, lead to significant portfolio growth without pain.

Long-term consistency transforms these habits into a natural part of your financial routine.

Quantifiable Impacts of Smart Habits

To visualize the power of small changes, consider the following examples of how minor actions can lead to major results.

These examples demonstrate that even modest efforts can yield impressive financial rewards.

Conclusion: Building a Brighter Financial Future

In the face of rising pessimism, smart money habits offer a path to resilience and prosperity.

By embracing the compound effect, you can turn small changes into lasting wealth.

Start today with one simple habit, and watch as it snowballs into transformative growth.

Remember, consistency is more powerful than intensity in achieving financial success.

With dedication and the right strategies, you can overcome challenges and secure a stable future.

References

- https://www.bankrate.com/banking/financial-outlook-survey/

- https://www.cbsnews.com/news/small-changes-that-could-have-a-big-impact-on-your-finances/

- https://www.fidelity.com/learning-center/personal-finance/2026-money-trends

- https://www.signaturewealthconcepts.com/literature/small-steps-big-gains-transform-your-finances-compound-effect

- https://www.youtube.com/watch?v=xravYq8n6vQ

- https://www.smithmosesandcozad.com/blog/how-to-make-small-changes-for-big-impacts

- https://www.vectrabank.com/personal/community/two-cents-blog/Save-Smarter-in-2026/

- https://www.schwab.com/learn/story/big-impact-small-changes

- https://www.youtube.com/watch?v=GMyszCllsPo

- https://www.gncu.org/blog/small-changes-big-savings-10-habits-to-save-more-in-the-new-year/

- https://www.nasdaq.com/articles/4-bad-money-habits-ditch-2026

- https://www.manafld.com/blog/2019/8/2/sometimes-financial-wellbeing-doesnt-start-with-money-small-changes-big-impact