Have you ever felt guilty about spending money, even when you know you should be saving more?

The traditional approach to saving often feels like a restrictive chore, but what if it could be an empowering and joyful practice?

Conscious saving reframes saving not as passive "stashing cash" but as mindful allocation aligned with personal values.

It is an intentional practice that goes beyond mere accumulation.

This method emphasizes intentionality over restriction, allowing you to automate finances to prioritize security while enabling guilt-free enjoyment.

By tying every dollar to your priorities, such as family, travel, or retirement, you build financial control and reduce stress.

This holistic approach transforms saving from a burden into a path toward a rich life.

What is Conscious Saving?

Conscious saving is about making financial decisions with purpose and awareness.

It shifts the focus from restriction to alignment with your deepest goals.

This practice integrates saving with overall life satisfaction, preventing debt and fostering resilience.

It extends beyond personal finance to business contexts, promoting goal achievement and stress reduction.

The core idea is to move from a scarcity mindset to one of abundance and control.

Key Principles to Embrace

At the heart of conscious saving are several guiding principles that make it effective.

Mindful decision-making involves pausing before purchases to assess alignment with values.

Ask yourself questions like: Will I use this? What is my motive? Can I afford it emotionally and financially?

This helps shift your self-concept from "spender" to "saver" for easier habit change.

Values-driven allocation means spending freely on what you love, such as hobbies or dinners.

Cut ruthlessly on indifferents, like daily coffee or unused subscriptions, to reduce buyer's remorse.

This ensures empowerment and impulse control without requiring perfectionism.

Holistic financial wellness connects saving with life satisfaction and long-term security.

It builds a foundation for financial independence and positive social impact.

To implement these principles, consider these actionable strategies:

- Automate your savings with direct deposit splits and auto-transfers.

- Use high-yield accounts to grow your money faster.

- Review your finances occasionally, rather than obsessively tracking every expense.

- Align spending with personal values to enhance joy and reduce stress.

The Conscious Spending Plan (CSP)

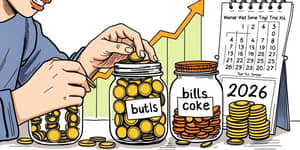

A practical tool for conscious saving is the Conscious Spending Plan, which divides income into customizable buckets.

The philosophy is simple: cover essentials first, secure your future, and then enjoy guilt-free.

For example, with a monthly take-home of $5,000, you might allocate 55-60% to fixed costs, 20% to investments/savings, and 25% to guilt-free spending.

This structure provides flexibility and ensures your money supports your life goals.

How It Compares to Traditional Budgeting

Conscious saving differs significantly from old-school budgeting methods.

Traditional budgeting often focuses on restrictions and tracking every expense, leading to frustration.

In contrast, conscious saving emphasizes intentionality and values alignment for empowerment.

While traditional methods use obsessive spreadsheets, conscious saving relies on automation and broad categories.

The outcome is not guilt but control, goal progress, and reduced financial stress.

Key differences include:

- Focus: Restrictions vs. intentionality.

- Mindset: Guilt vs. joy.

- Tracking: Detailed line items vs. occasional reviews.

- Outcome: Frustration vs. financial freedom.

Practical Steps to Get Started

Implementing conscious saving is straightforward with these steps.

First, track your expenses for 1-2 months to identify leaks, such as unnecessary ride-shares.

Adjust by finding alternatives, like biking instead, to free up funds.

Second, set up separate accounts for each bucket and split your direct deposit accordingly.

A common split is 60% for fixed costs, 10% for savings, 10% for investments, and 20% for guilt-free spending.

Third, build an emergency fund with 3-6 months of expenses in a high-yield savings account.

Automate transfers to make this process effortless and consistent.

Fourth, create savings buckets for specific goals to stay motivated.

Common buckets include:

- Emergency fund for unexpected costs.

- Rainy day fund for minor repairs.

- Sinking fund for upcoming bills.

- Vacation fund for travel dreams.

- Splurge fund for personal treats.

- Medical fund for health expenses.

- Long-term fund for retirement or big purchases.

Fifth, make ongoing tweaks to your plan, especially in high-cost areas where fixed costs may rise.

Boost savings percentages when working toward big goals like home ownership or business expansion.

Sixth, use a pre-purchase checklist with questions to guide spending decisions and reinforce mindful habits.

Real-Life Success Stories

Conscious saving has transformed many lives with tangible results.

Jordan tracked his expenses and cut ride-shares by switching to biking.

He allocated funds to debt payoff and trips, becoming debt-free in three years while still traveling.

Sarah, a business owner, used CSP to save $2,000 for emergencies and expansion, with $1,000 for team perks.

April and Kevin structured their guilt-free spending to enjoy life without financial anxiety.

These examples show that conscious saving is practical, effective, and adaptable to different situations.

The Broader Benefits and Long-Term Impact

Conscious saving offers numerous advantages beyond mere accumulation.

It reduces overspending and financial stress, building savings for stability and resilience.

By adopting ESG-conscious saving, you can manage risks and support firms that outperform others.

Households often form saving patterns based on consumption similarities, linking to distinct financial behaviors.

Rules of thumb, like keeping fixed essentials under 50% of income, help maintain balance.

Automation allows savings to grow faster, especially with high-yield accounts offering above-average rates.

Long-term, this approach leads to financial freedom, goal achievement, and positive social impact.

Key benefits include:

- Enhanced financial control and reduced stress.

- Goal achievement for personal and business aspirations.

- Positive social and environmental impact through conscious choices.

- Increased life satisfaction and joy in spending.

Conclusion: Embrace Your Rich Life

Conscious saving is more than a financial strategy; it is a lifestyle that brings joy and empowerment.

By automating your finances, aligning spending with your values, and enjoying guilt-free, you can achieve a rich life.

Start today by implementing a Conscious Spending Plan and embracing the mindset shift toward intentional saving.

Remember, every dollar you save is a step toward your dreams and a testament to your financial wisdom.

References

- https://www.iwillteachyoutoberich.com/conscious-spending-basics/

- https://students.austincc.edu/infohub/2025/05/21/are-you-a-spender-or-saver-how-to-become-a-more-conscious-consumer/

- https://www.synchrony.com/blog/bank/what-is-conscious-spending-plan

- https://www.nerdwallet.com/finance/learn/how-to-save-money

- https://www.moneyfit.org/intentional-spending/

- https://www.firstcitizens.com/personal/insights/saving/saving-vs-spending-tips

- https://boolkah.com/conscious-spending-plan/

- https://www.bcg.com/publications/2021/sustaining-cost-conscious-culture

- https://www.carboncollective.co/sustainable-investing/conscious-investments

- https://pmc.ncbi.nlm.nih.gov/articles/PMC5125729/

- https://www.jeniusbank.com/blog/articles/conscious-spending-plan

- https://www.consumerfinance.gov/an-essential-guide-to-building-an-emergency-fund/

- https://www.beaumontwealth.co.uk/what-is-financial-well-being/

- https://www.jeniusbank.com/blog/articles/savings-categories-and-buckets

- https://www.ufcu.org/resources/articles/detail/articles/2024/10/21/spender-or-saver-how-to-become-a-more-conscious-consumer