In the world of investing, every decision involves a delicate balance between risk and return.

This is where the efficient frontier comes into play, offering a scientific approach to portfolio management.

Introduced by economist Harry Markowitz in 1952, it provides a graphical representation of optimal investment combinations.

The Birth of Modern Portfolio Theory

Harry Markowitz's groundbreaking work laid the foundation for modern portfolio theory.

He showed that diversification could reduce risk without sacrificing returns.

This insight transformed how investors approach asset allocation.

- Markowitz published his seminal paper in 1952, earning a Nobel Prize.

- The model assumes investors are rational and risk-averse.

- It uses standard deviation to measure investment volatility.

This led to the development of the efficient frontier as we know it today.

Understanding the Graphical Mechanics

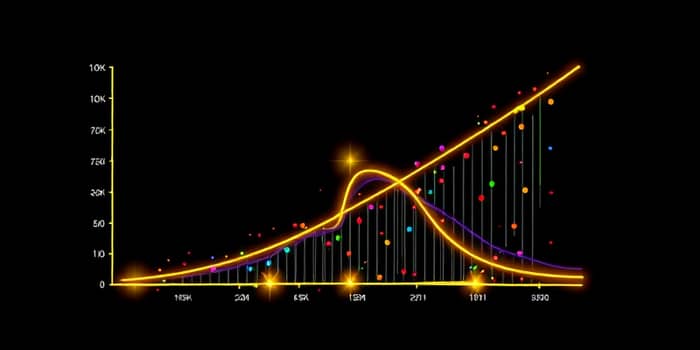

The efficient frontier is plotted on a graph with risk on the x-axis and expected return on the y-axis.

It depicts the highest possible return for each level of risk.

Portfolios on this curve are considered efficient and optimal.

- Those below the frontier are suboptimal and should be avoided.

- The shape is curved due to asset correlations and diminishing returns.

- With a risk-free asset, the frontier becomes a straight line.

By combining different assets, investors can move their portfolios towards this boundary.

This table illustrates the key differences between portfolio types.

Core Assumptions of the Model

The efficient frontier relies on several assumptions from modern portfolio theory.

These include rational investors and normally distributed returns.

- Investors are assumed to be rational and prefer higher returns.

- Risk is measured solely by volatility or standard deviation.

- Markets are efficient with all information priced in.

- Unlimited borrowing and lending at a constant risk-free rate.

- Transaction costs and taxes are ignored for simplicity.

These assumptions enable the model but also introduce practical limitations.

Practical Benefits for Investors

Using the efficient frontier can significantly enhance investment strategies.

It emphasizes diversification to achieve better risk-adjusted returns.

- It helps in benchmarking portfolios for efficiency and performance.

- Investors can align their asset allocation with personal risk tolerance.

- The model provides a clear framework for long-term financial planning.

Steps to construct an efficient portfolio are straightforward and actionable.

- First, select a diverse set of potential investments.

- Next, estimate expected returns, standard deviations, and correlations.

- Then, use mean-variance optimization to find efficient combinations.

- Finally, plot the results and choose based on risk preference.

This process empowers investors to make informed decisions.

Criticisms and Real-World Challenges

Despite its elegance, the efficient frontier has faced significant criticism.

It often overrelies on historical data estimates.

- Assumptions like rational behavior may not hold in real markets.

- Returns frequently deviate from normal distributions with fat tails.

- Practical issues include transaction costs, taxes, and market inefficiencies.

- The model is highly sensitive to input parameters, leading to volatility.

Investors should be aware of these drawbacks when applying the concept.

Extensions and Modern Applications

The efficient frontier has been extended through models like the Capital Asset Pricing Model (CAPM).

This introduces a risk-free asset, creating the Capital Market Line.

- The tangency portfolio represents the market portfolio in equilibrium.

- Mean-variance optimization remains a core mathematical tool.

- Modern software makes it accessible for individual and institutional use.

These advancements keep the concept relevant in today's financial landscape.

The efficient frontier continues to inspire investors to think critically.

It encourages a disciplined approach to balancing risk and reward.

By mastering this concept, one can navigate market complexities with confidence.

Embrace the efficient frontier to build more resilient and profitable portfolios.

It serves as a timeless guide in the ever-evolving world of finance.

Remember, the journey towards optimal investing starts with understanding these principles.

References

- https://www.equiruswealth.com/glossary/efficient-frontier

- https://en.wikipedia.org/wiki/Efficient_frontier

- https://www.fe.training/free-resources/portfolio-management/efficient-frontier/

- https://verumpartnership.com/understanding-the-efficient-frontier-in-portfolio-construction/

- https://fintelligents.com/efficient-frontier/

- https://corporatefinanceinstitute.com/resources/career-map/sell-side/capital-markets/efficient-frontier/

- https://www.investglass.com/fr/the-efficient-frontier-graph-a-guide-to-smarter-investing/

- https://diversiview.online/help/difference-between-efficient-frontier-positions-and-optimal-portfolio/