In today’s complex financial landscape, many investors seek more than just profit. They yearn to make choices that resonate with their deepest convictions and leave a positive mark on the world. Ethical investing has emerged as a powerful way to bridge personal values and financial performance, offering both inspiration and practical guidance for those determined to do well while doing good.

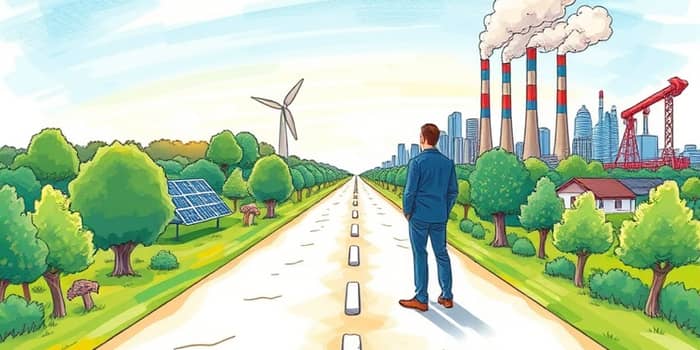

At its core, ethical investing is the practice of allocating capital towards investments that align with an individual’s or organization’s moral, ethical, or social values. Unlike traditional strategies that focus solely on returns, ethical investors evaluate the broader impact of their portfolios on society and the environment, ensuring that every dollar works in harmony with their beliefs.

Historical Context and Modern Relevance

Ethical investing is not a new phenomenon. Its roots can be traced back centuries to faith-based endowments and community cooperatives that sought to balance profit with purpose. Over time, this practice has evolved into a sophisticated field encompassing diverse approaches such as Socially Responsible Investing (SRI), Impact Investing, and Environmental, Social, and Governance (ESG) criteria.

In recent decades, growing awareness of climate change, social justice movements, and corporate governance scandals has fueled a surge in demand for ethical investment options. Investors are no longer content to remain passive shareholders; they want to shape corporate behavior, support sustainable innovation, and stand against practices they find objectionable. This shift demonstrates that ethical investing is more than just a trend—it's a lasting commitment to aligning capital with conscience.

Core Principles of Ethical Investing

While individual definitions of ethics may vary, most ethical investment frameworks share several common goals:

- Promote sustainable business practices that protect natural resources and reduce pollution

- Support social and environmental causes such as human rights, fair labor, and community development

- Generate competitive financial returns while maintaining alignment with personal values

By establishing a clear ethical investment policy statement, investors articulate their values, objectives, and criteria, creating a roadmap for portfolio selection and ongoing evaluation.

ESG Criteria: A Structured Framework

Environmental, Social, and Governance (ESG) factors have become the gold standard for assessing a company’s ethical performance. These criteria provide measurable benchmarks that help investors compare and select opportunities based on tangible metrics.

Integrating ESG criteria allows investors to pursue a measurable, positive social or environmental impact while maintaining a disciplined financial approach. Data providers like MSCI and Morningstar offer ratings that simplify the process of screening companies against these benchmarks.

Investment Strategies for Ethical Portfolios

Ethical investors employ a range of strategies to construct portfolios that reflect their values:

- Positive screening: Select companies with strong ESG performance and a commitment to sustainability

- Negative screening: Avoid companies involved in controversial industries such as tobacco, fossil fuels, or weapons

- Best-in-class approach: Reward industry leaders by choosing top performers within each sector

- Shareholder activism: Engage directly with company management to advocate for change

- Thematic investing: Focus on specific trends like renewable energy or gender equality

These strategies can be combined to create a dynamic portfolio that balances risk, return, and impact in line with individual priorities.

Building Your Ethical Portfolio

Constructing a robust ethical portfolio requires careful planning and ongoing oversight. Follow these practical steps to get started:

- Define your personal values and investment objectives, clarifying non-negotiables and aspirational goals

- Choose suitable products, including individual stocks, ETFs, mutual funds, green bonds, and community investments

- Research ESG ratings and fund prospectuses to ensure alignment with your criteria

- Diversify across various sectors and asset classes effectively to spread risk and capture diverse opportunities

- Monitor performance and impact regularly, adjusting holdings as companies evolve or new data emerges

- Engage with fund managers and participate in shareholder resolutions to amplify your influence

Navigating Financial Performance and Risk

One of the most common concerns about ethical investing is whether it sacrifices returns. Empirical studies have shown that companies with sound ESG practices often demonstrate resilience during market downturns, due to stronger management of environmental risks, proactive community engagement, and transparent governance.

By steering clear of businesses prone to regulatory fines, environmental liabilities, or reputational scandals, ethical portfolios can enjoy long-term environmental stewardship and responsible resource oversight while remaining competitive. Moreover, many sustainable and impact-focused funds have delivered returns on par with, or even exceeding, their conventional counterparts.

Measuring Impact

Beyond financial metrics, ethical investors track social and environmental outcomes to gauge success. Common indicators include:

- Carbon emissions avoided or reduced

- Number of sustainable projects financed

- Improvements in labor or diversity practices within portfolio companies

Regular impact reports from fund managers, third-party certifications, and proprietary dashboards can help quantify progress, ensuring that your investments make a tangible difference.

Overcoming Challenges and Maintaining Alignment

Ethical investing is a journey, not a destination. Investors must remain vigilant against pitfalls such as greenwashing, inconsistent reporting, and evolving personal values. To stay on course, cultivate a network of informed advisors and peers, participate in industry forums, and continuously refine your criteria based on new insights.

Remember that true alignment requires both introspection and action. Be prepared to question assumptions, celebrate successes, and learn from setbacks. By doing so, you empower yourself to uphold your moral compass in their investment choices and inspire others to follow suit.

Conclusion

Ethical investing transcends conventional finance by placing purpose alongside profit. It offers a pathway for individuals and institutions to channel their resources toward companies and projects that champion sustainability, social justice, and sound governance. Whether you are a seasoned portfolio manager or an aspiring individual investor, embracing the principles outlined here can lead to a fulfilling and impactful financial journey.

As global challenges intensify, the role of the ethical investor becomes ever more critical. By combining rigorous financial analysis with a steadfast commitment to positive change, you can cultivate a portfolio that not only secures your future but also contributes to the greater good of our planet and society.

References

- https://www.carboncollective.co/sustainable-investing/ethical-investing

- https://corporatefinanceinstitute.com/resources/esg/ethical-investing/

- https://www.imd.org/blog/sustainability/ethical-investing/

- https://greenly.earth/en-us/blog/industries/ethical-investments-definition-principles-pros-and-cons

- https://www.nerdwallet.com/investing/learn/ethical-investing

- https://ca.rbcwealthmanagement.com/web/sameer.azam/ethicalinvesting

- https://www.unpri.org/about-PRI/what-principles-for-responsible-investment

- https://www.castlefield.com/home/thoughtful-investor/what-is-ethical-investing/